Strategic Solutions

M&A: Shaping the Adhesives Landscape

The hopes for a 2025 M&A recovery were set back by economic uncertainty and valuation gaps, but improving conditions are reviving optimism for 2026.

By Julie Vaughn Biege, Vice President, The ChemQuest Group, Inc.

M&A: Shaping the Adhesives Landscape

The hopes for a 2025 M&A recovery were set back by economic uncertainty and valuation gaps, but improving conditions are reviving optimism for 2026.

The adhesives and sealants industry has historically been an attractive space for investment. The substitution of mechanical fasteners with adhesives, bonding of new substrate materials, changes in packaging materials and design, and growth in medical and electronics (including new formats in wearables) all drive innovation, growth, and new needs in the market. Companies have reconsidered their strategies and shifted their portfolios, and the competitive landscape has undergone many changes over the last couple of decades.

It all begins with leadership and a vision. Like a puzzle, what is the image the company seeks to create? The roadmap in Figure 1 highlights the key steps in building and transforming a company for profitable growth — focusing on attractive segments that align with the core competencies and emerging market needs. Leaders must consider the missing pieces in their puzzle to create their vision. Are there gaps in technology platforms, commercial resources, brand recognition and position, operational efficiency, or manufacturing capabilities?

Figure 1: Key steps in building and transforming a company for profitable growth. Source: The ChemQuest Group, Inc.

Identifying the gaps is just the first step. Developing and executing successful strategies to get there are the next and critical phases. Companies must consider organic routes involving internal development or inorganic routes involving acquisition as a part of their strategic options. Often, companies will embark on both.

Factors to consider include the size of the gap, internal resources, availability of external resources and acquisition targets, capital, and timing expectations. This article will focus on the M&A route — both historically and in terms of the current M&A situation in light of post-COVID market disruptions and challenges for a full recovery given volatility in the geopolitical climate.

M&A in Adhesives & Sealants over the Years

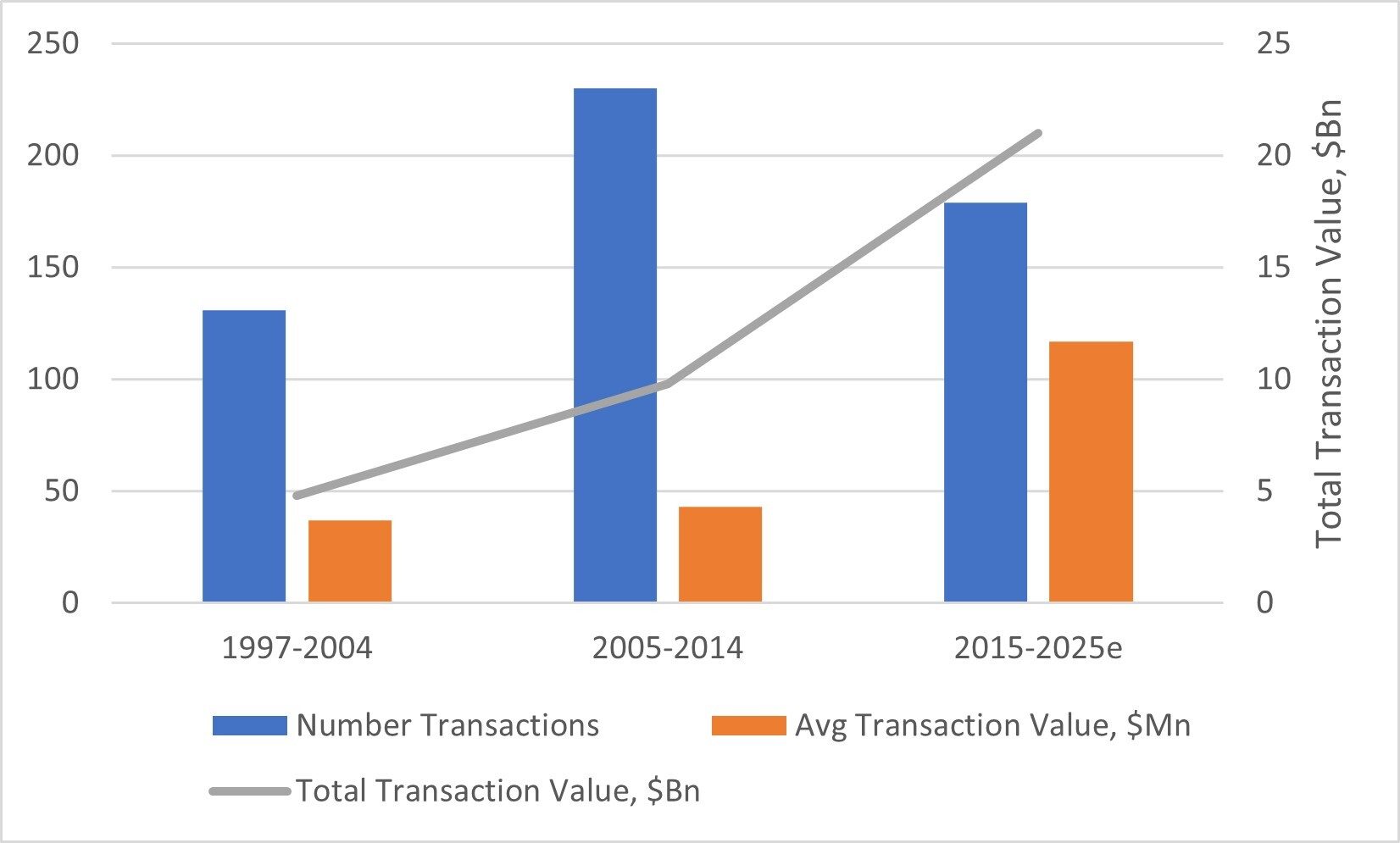

M&A activities have been a significant part of the growth strategy for both strategic and private equity (PE) companies. Looking at the last nearly three decades, there has been an increasing trend in the number and value of transactions (with the exception of dips following disruptions such as the Great Recession and the pandemic/inflationary period), as shown in Figure 2.1,2,3

Figure 2: Global M&A in the adhesives and sealants industry. Source: The ChemQuest Group, Inc.

Strategic buyers make up a significant majority — approximately 80% of the deals over this time period. Of these strategic buyers, five companies lead the pack, accounting for 20% of the acquisitions by deal volume.4 These companies include Sika, Henkel, H.B. Fuller, Soudal, and Tremco (RPM International), as they seek to expand and reshape their portfolios. Multinationals have also utilized cross-border deals as a key pillar of their growth strategy in order to: leverage sales, marketing, and technology resources; create raw material synergies; and optimize their global manufacturing footprint (see sidebar).

Examples of Strategic Companies Reshaping Through M&A

Henkel completed 33 acquisitions over the last couple of decades in both consumer segments and adhesives, with a peak of four per year. Adhesive acquisitions include: Loctite (1997); electronic adhesives and materials from National Starch/AkzoNobel (2008); and maintenance, repair, and operations (MRO) applications with Seal for Life (2024).5

Arkema acquired Bostik in 2015. Since then, Bostik has made six key acquisitions in adhesives, including Den Braven’s high-performance sealants in Europe, two flooring adhesives lines, Ashland’s performance adhesives business (2022), and Dow’s flexible packaging business (2024).6

Sika continues to build its portfolio of offerings in chemicals, mortars, and finishing materials for construction applications, building upon the adhesives business it acquired from AkzoNobel in 2013. In recent years, Sika acquired MasterBuilders (ex-BASF) in 2023, Parex Group (2019), HPS North America (2025), and Gulf Additive Factory (2025). These acquisitions also bolster the company's presence in the Middle East and Asia.7

H.B. Fuller is another good example of reshaping a portfolio through strategic M&A. The company's investor overview cites 15 acquisitions over the past five years, as well as two divestitures of non-core businesses. Major acquisitions include The Royal Company in 2017, and smaller acquisitions have involved medical adhesives, wound closure, and construction sealants, as well as others in high-value applications in electronics, transportation, and aerospace. H.B. Fuller also made acquisitions to increase international presence in UAE, Belgium, the UK, and China.8

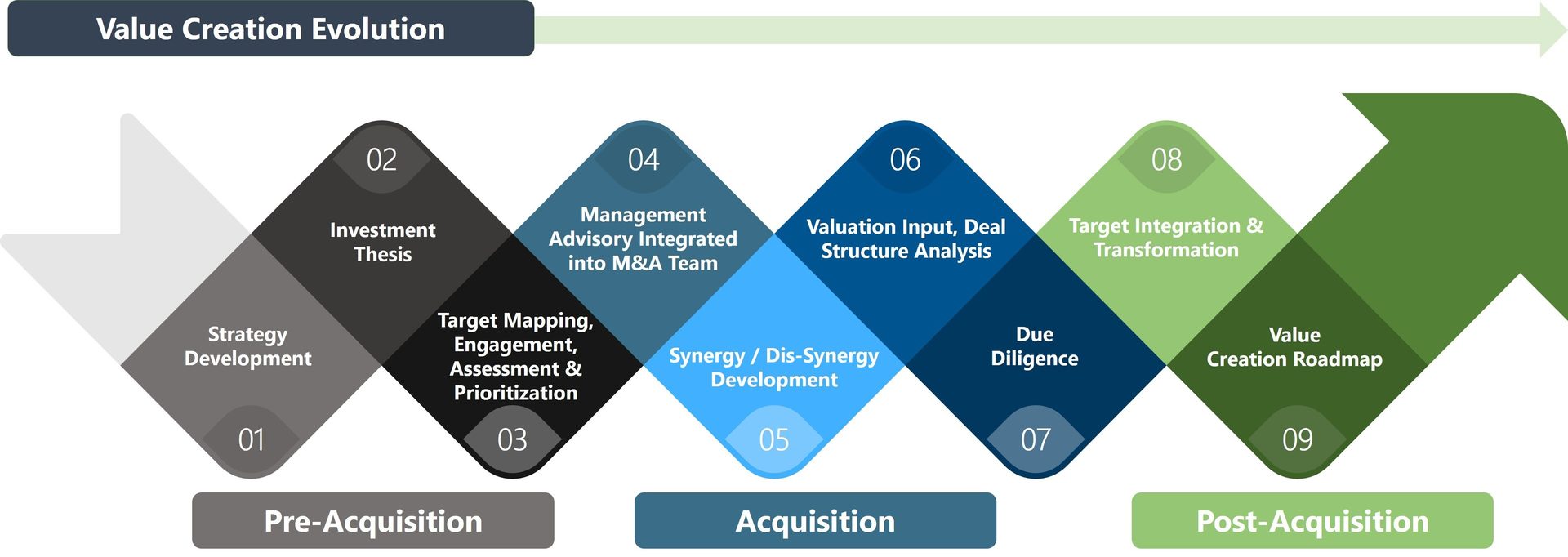

Private equity (PE) firms have also been a significant factor in M&A for adhesives and sealants. PE buyers have increased their share of deals in recent years from 20% historically to now comprise about 25% of deals.4 While strategic buyers traditionally have paid higher multiples, this trend has been gradually changing from 8.3X to close to 12X over the past decade.9 PE buyers have been taking a disciplined approach to developing a strategy and, importantly, a clear and cohesive investment thesis for a buy-and-build strategy, identifying profiles of targets that fit that thesis, with the goal of creating a platform of a "string of pearls" from small and mid-sized firms. Figure 3 depicts this process. Because of this successful approach, PE firms have been able to create and capture more value.

Figure 3: Buy-and-build strategies enable PE firms to capture more value. Source: The ChemQuest Group, Inc.

PE Platform Examples

The Meridian Adhesives Group10

- Formed by Arsenal Capital in 2018 with the purchase of ATC and Epoxy Technology (sold to American Securities in 2022)

- Made 13 total acquisitions over the years

- Recently sold its flooring adhesives segment to Avery Dennison (October 2025)

Applied Adhesives11

- Formed via merger in 2012 by sponsor Ellipse Capital

- Subsequent sponsors: Goldner Hawn (2017), Arsenal (2021), and Bertram Capital (2025)

- Expanded through 17 strategic acquisitions over the years

Choice Adhesives12

- BlueArc, formed by merger in 2018

- Sold to ICP Group, a platform company of Audax Group, in 2021 to enhance offerings in roofing

Royal Adhesives

- Well-documented success story9

- Arsenal acquired Parachem in 2010

- Sponsors Arsenal and American Securities added on 10 companies

- Sold to H.B. Fuller in 2017

Fragmentation

The adhesives and sealants market is characterized by five companies that account for close to one-third of the global market. This is a lower percentage held by leading players than other markets, such as coatings. The industry also includes a long tail of many hundreds of small and mid-sized companies, most of which are below the $200 million range. This landscape has enabled the acquisition of the previously described strategic "bite-sized" targets, which tend to be purchased at lower multiples than larger enterprises and represent the profitable building of platform companies and attractive bolt-ons for strategic companies.

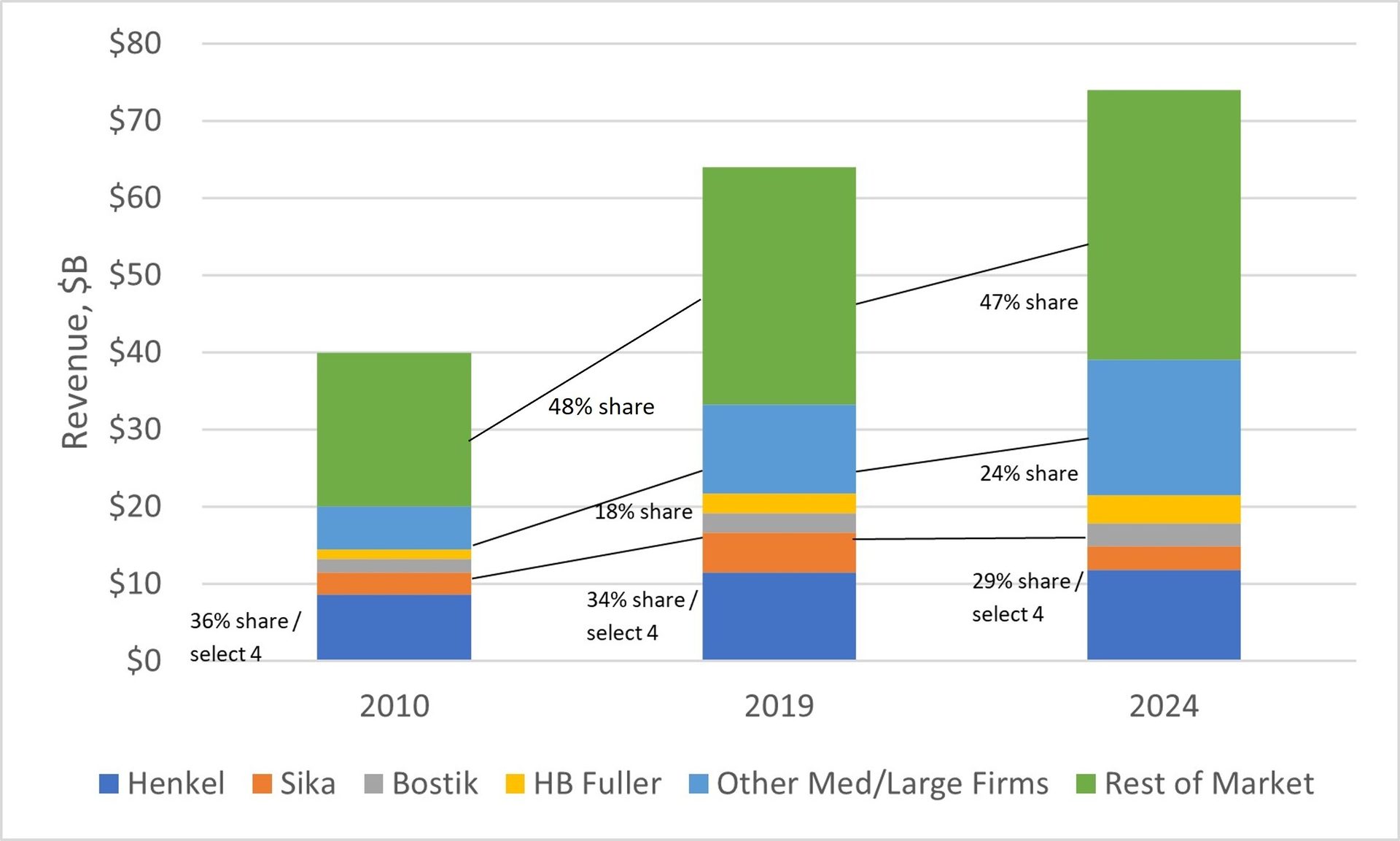

Despite the M&A activity and portfolio reshaping activities by market participants over recent decades, fragmentation remains in the adhesives and sealants sector. While regional differences come into play, the overall level of concentration globally has not materially changed over the last 15 years. The market revenue has nearly doubled in value over that timeframe (see Figure 4). While revenue at all tiers has grown, the share percentage has not grown evenly by all tiers. Instead, the share of the medium/larger firms in the middle has grown, while the share of the smaller firms and the combined sales of "top 4" category have been stable or declined. This dynamic continues to bode well for growth and M&A opportunities in the adhesives and sealants industry.

Figure 4: Market size and share trends in adhesives and sealants. Source: The ChemQuest Group, Inc.

Current M&A Market Situation: Challenges and Outlook

Optimism in the M&A market abounded for 2025. As the year started, leading companies such as Ernst & Young,13 KPMG,14 and BCG15 were all optimistic for a robust recovery, with dealmakers poised to reengage in the M&A market. There were lofty expectations for an improved business climate, regulatory easing, a recession that did not materialize, and valuations normalizing. Further, the dry powder for financial buyers reached extraordinary levels (estimated at more than $2 trillion globally).16

Unfortunately, the expectations for an M&A recovery were lofty indeed. Since the M&A low in December 2022, continued market disruptions, geopolitical situations and conflict, inflation, and higher interest rates weighed on businesses. M&A activities were postponed in expectation of a more favorable climate, suppressing deal supply. Average exit hold times for PE-owned portfolio companies reached an all-time high of 8.5 years in 2024 — more than double the 4.1 years seen in 2007.16

So, what really happened? The expected interest rate reductions and growth did not materialize. Adding these factors to other uncertainties (e.g., tariffs and their commercial impact, deal risk increases) created a drag on results and led to a disconnect between sellers and buyers on valuations. In a recent interview, Scott Wolff, president of PE firm American Securities, indicated that 60% of the deals were withdrawn from the market in the past year — unsold — as a result of the disconnect on valuations. This is considerably higher than the 15-20% in a typical year.17 That said, some strategics did use the opportunity to divest non-core assets while the number of buy-side deals were in short supply.

In adhesives and sealants, the overall market remains an attractive investment. Companies seek growth through innovation and acquisition to reshape their portfolios as they chase margins, specialize in certain segments, and add key capabilities (e.g., geographic reach, channels to market). Yet uncertainty and headwinds prevailed in 2025.

New and frequently shifting tariffs have added to business uncertainty, complexity, and frustration for many in the supply chain as they source and price products.18 A survey conducted by the Adhesive and Sealant Council in August 2025 indicated many companies import a range of materials and adhesive and sealant products.19 Certain tackifiers that are critical in hot-melt formulations represent just one example.

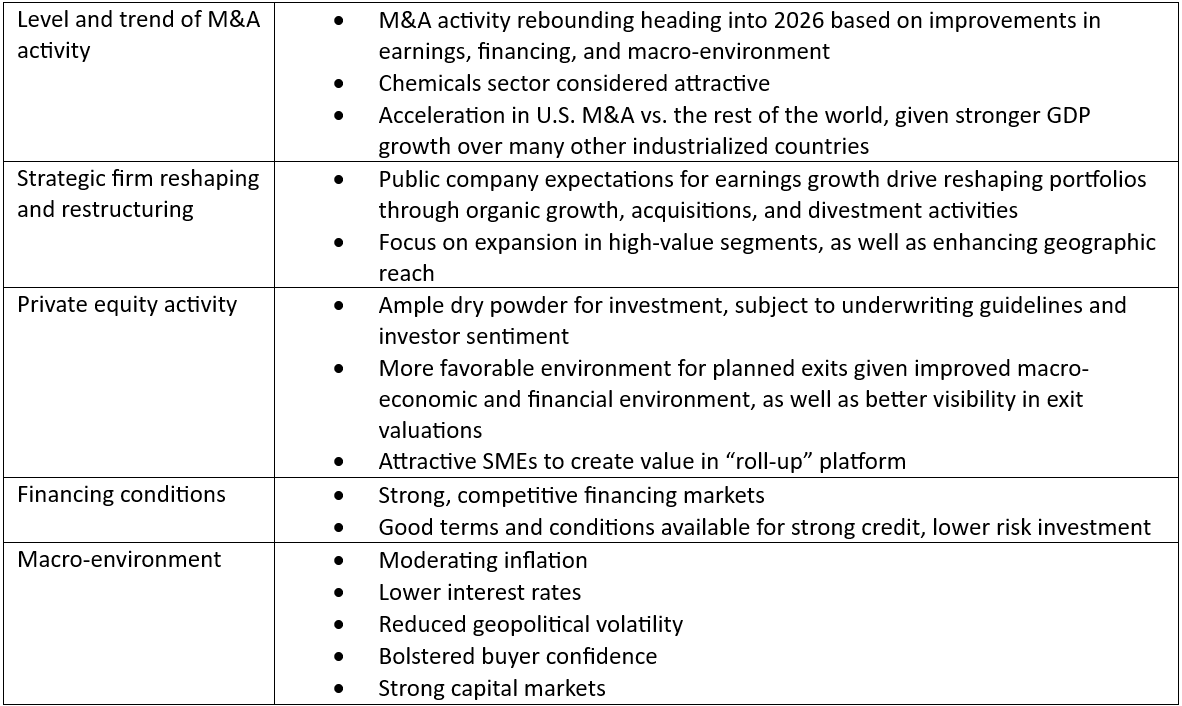

What’s ahead for 2026? As was the case last year, we’re seeing a lot of optimism. However, the environment is now more favorable18 — fewer headwinds and more tailwinds are fueling the market, as shown in Table 1.2

Table 1: Looking forward to 2026 – key considerations in the M&A environment.

The dry powder of pent-up demand still remains, and private equity is feeling the pressure for exits to realize a return on invested capital. Even better, some of the headwinds show signs of mitigating: interest rates have begun to drop, with expectations that the U.S. Federal Reserve will continue to drop rates modestly in 2026; companies are seeing positive trailing 12-month (TTM) financial metrics; and the turbulent tariff policies show some indication of stabilization, as the administration balances its goals for trade and other policy issues while seeking to address affordability issues. Clarity reduces risk, and all these factors bode well for a strong 2026 M&A market.

To learn more, contact the author at jvaughnbiege@chemquest.com or visit chemquest.com.

References

- “Chemical Industry Updates: Paints Coatings and Adhesives,” Fermium Research and The ChemQuest Group, Inc., September 3, 2025, p. 5.

- Harfouche, Alain, “Adhesives & Sealants Market M&A Update—Value Creation Considerations,” presentation at the Adhesive and Sealant Council Executive Leadership Conference, October 2025.

- “Chemicals, Analysis of Coatings, Adhesives and Sealants,” BBT Capital Markets and The ChemQuest Group, Inc., 2010.

- “North American Adhesives and Sealants Market, 2021-2023,” The ChemQuest Group and the Adhesive and Sealant Council, 2021, pp. 637-639.

- “Acquisitions & Divestments,” Henkel, https://www.henkel.com/investors-and-analysts/strategy-and-facts/acquisitions-divestments, accessed December 17, 2025.

- “Bostik: a tale of successful integration,” Arkema Global, https://www.arkema.com/global/en/arkema-group/strategy/bolt-on-acquisitions/bostik-iconic-acquisition/; “Understanding Our Latest Acquisition: Dow’s Laminating Adhesives and Coatings Business,” Bostik US, https://www.bostik.com/us/en_US/blog/post/advanced-packaging/flexible/nam/bostik-us-post-understanding-our-latest-acquisition/, both accessed December 17, 2025.

- “Acquisitions,” Sika, https://www.sika.com/en/about-us/strategy/acquisitions.html.

- “H.B. Fuller Completes Strategic Acquisitions Consistent with Profitable Growth Strategy,” H.B. Fuller, June 22, 2023, https://investors.hbfuller.com/news/news-details/2023/H.B.-Fuller-Completes-Strategic-Acquisitions-Consistent-with-Profitable-Growth-Strategy/default.aspx; “June 2025 Investment Highlights,” H.B. Fuller, https://s26.q4cdn.com/617714526/files/doc_downloads/2025/07/HB-FULLER-Investment-Highlights-July-2025-FINAL.pdf, accessed December 17, 2025.

- Murad, Daniel and Harrs, Lee, “Challenges in M&A Valuation: Premium Valuation Drivers to Consider, presentation at the Adhesive and Sealant Council Executive Leadership Conference, October 2023, pp. 10-16.

- “Adhesives that go the distance,” Meridian Adhesives, https://meridianadhesives.com/; “American Securities Acquires Meridian Adhesives Group,” Meridian Adhesives, September 8, 2022, https://meridianadhesives.com/about/news/american-securities-acquires-meridian-adhesives-group-from-arsenal-capital-partners/; “Specialty Adhesives to a Variety of End Markets,” Arsenal Capital Partners, https://www.arsenalcapital.com/portfolio/meridian-adhesives.

- “Arsenal Completes Sale of APPLIED Adhesives to Bertram Capital,” PR Newswire, April 15, 2025, https://www.prnewswire.com/news-releases/arsenal-completes-sale-of-applied-adhesives-to-bertram-capital-302428434.html.

- “ICP Enters Acquisition Agreement with Choice Adhesives, Bolstering Roofing Solutions Portfolio, ICP Group, April 19, 2021, https://www.icpgroup.com/icp-enters-acquisition-agreement-with-choice-adhesives-bolstering-roofing-solutions-portfolio/; “Choice Brands Adhesives and Slocum Adhesives,” Merit Capital, https://www.meritcapital.com/portfolios/choice-slocum-holdings-llc/.

- Daco, Gregory and Berlin, Mitch, “M&A outlook: stronger US deal market in 2026 despite mixed economic signals,” EY-US, October 28, 2025, https://www.ey.com/en_us/insights/mergers-acquisitions/m-and-a-outlook.

- Claydon, Liz and Rodriguez, Javier, “M&A outlook 2025,” KPMG, https://kpmg.com/xx/en/our-insights/value-creation/m-and-a-outlook-2025.html.

- Kengelbach, Jens; Friedman, Daniel; and Degen, Dominik, “M&A Outlook 2025: Expectations Are High,” BCG, January 15, 2025, https://www.bcg.com/publications/2025/m-and-a-outlook-2025-expectations-high.

- Henry, Jake and Van Oostende, Mieke, “M&A Annual Report: Is the wave finally arriving?,” McKinsey & Co., February 19, 2025, https://www.mckinsey.com/capabilities/m-and-a/our-insights/top-m-and-a-trends#/.

- “The M&A Environment,” Egon Zehnder, interview with Scott Wolfe at the 2025 US Chemical and Process Industries Forum, https://www.linkedin.com/posts/scott-wolff-5467683_president-scott-wolff-sat-down-with-bertrand-activity-7391555174072209410-6asu?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAKjtDQBQ0x4hqjDslHq5CC0e_v5dOVjNgo.

- “Market Update: Near Term M&A Outlook is Improving,” Grace Matthews, Fall 2025 Newsletter, https://gracematthews.com/newsletter-2025-fall/.

- Industry survey, Adhesive and Sealant Council, 2025.

Opening image credit of MicroStockHub / iStock / Getty Images Plus.